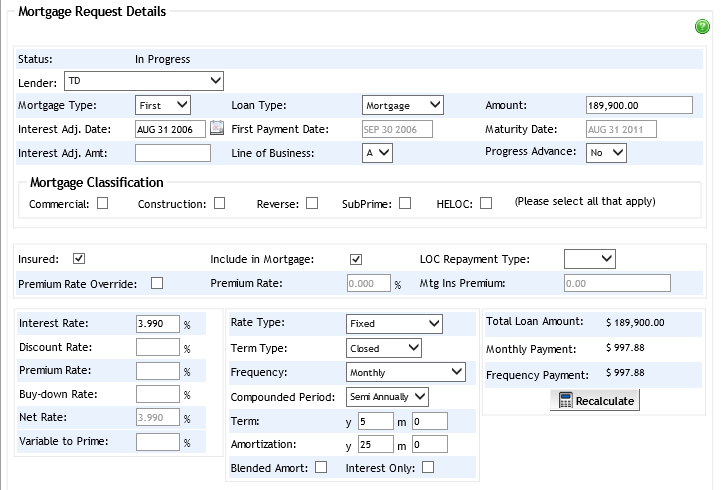

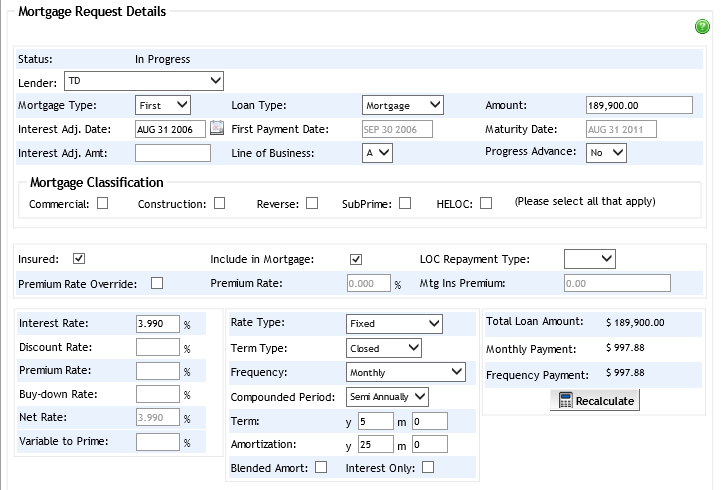

Mortgage request details are entered in the Mortgage Request Details section of the Application Edit screen. This section can be directly accessed by clicking Application Information > Mortgage Request Details in the Left Navigation Pane. See below for details regarding this screen:

Mortgage

Request Details Fields

Why

Can't I Edit the Mortgage Request Details?

Enter

the required information for the mortgage being requested. Tip!

Use the Tab key to move from field

to field; use the Shift-Tab key

combination to move backwards.

By optionally selecting a lender from the Lender

dropdown, any mortgage products offered by that Lender are available from

the Product dropdown. Selecting

the mortgage product will in turn automatically populate the various fields

inherent to that product (Interest Rate,

Rate Type, Term

Type, Compounded Period,

Term, and Amortization).

In addition, any cross-selling products offered by the selected lender

(such as creditor

insurance) appear in a separate link in the Left Navigation

Pane. Clicking this product link from the lender will open the appropriate

page for you to enter the information required of the product.

By default, the Loan Type dropdown

displays Mortgage. However, if

the lender offers an LOC product, then the loan type can be Secured

LOC.

Note that the Line of Business is a means to classify the value or ranking of a deal. LOB A is low risk, LOB B is medium risk, and LOB C is high risk.

Click the Recalculate button to see the results for the Total Loan Amount, Monthly Payment, and Frequency Payment.

Note: Be aware that the Qualifying Details section affects GDS and TDS ratios. The Qualifying Details section is to enter the current government-required qualifying details.

If the mortgage is to receive mortgage loan insurance, then ensure the Insured checkbox is selected.

The premium rate is displayed by default in the Premium Rate field. To make this field editable to override the amount, click the Premium Rate Override checkbox.

The insurance premium is calculated automatically and displayed in the Mtg Ins Premium (Mortgage Insurance Premium) field.

If the Loan Type is Secured

LOC, select one of the following payment options:

5/20 - Initial 5-year period of interest only payments followed by 20 years amortizing principal and interest repayment, with full repayment within 25 years of loan initiation; or

10/15 - Initial 10-year period of interest only payments followed by 15 years amortizing principal and interest repayment, with full repayment within 25 years of loan initiation.

To include the mortgage premium in the mortgage amount, click the Include in Mortgage checkbox. After clicking the Recalculate button, the Total Loan Amount field updates accordingly.

If you access an existing deal,

the find that the Mortgage Request Details cannot be edited, it means

the mortgage has already been accepted

in Expert. To make changes to the Mortgage Request Details you will

be required to un-accept

the lender response, which will unlock the fields.

or

If you access an existing deal, and cannot select a Mortgage Type (i.e., first, second, or third) for the Mortgage Request Details, it indicates that the mortgage has been co-brokered. To edit these details, you will be required to break the link to the co-brokered mortgage. See Breaking Link to a Co-Brokered Mortgage.